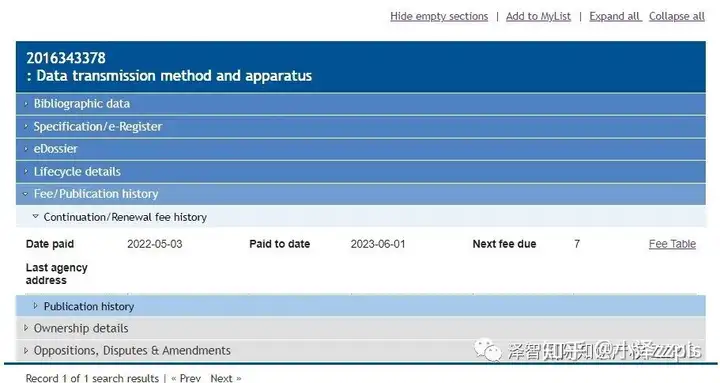

Annual fee website: ipaustralia.gov.au/mana

| invention patent | ||

| Year (Anniversary) | Annual fee (AUD) | |

| electronic submission | other ways | |

| 4 | 300 | 350 |

| 5 | 315 | 365 |

| 6 | 335 | 385 |

| 7 | 360 | 410 |

| 8 | 390 | 440 |

| 9 | 425 | 475 |

| 10 | 490 | 540 |

| 11 | 585 | 635 |

| 12 | 710 | 760 |

| 13 | 865 | 915 |

| 14 | 1050 | 1100 |

| 15 | 1280 | 1330 |

| 16 | 1555 | 1605 |

| 17 | 1875 | 1925 |

| 18 | 2240 | 2290 |

| 19 | 2650 | 2700 |

| 20 | 4000 | 4050 |

| 21 | 5000 | 5050 |

| 22 | 6000 | 6050 |

| 23 | 7000 | 7050 |

| 24 | 8000 | 8050 |

| Utility model | ||

| Year (Anniversary) | Annual fee (AUD) | |

| electronic submission | other ways | |

| 2 | 110 | 160 |

| 3 | 110 | 160 |

| 4 | 110 | 160 |

| 5 | 220 | 270 |

| 6 | 220 | 270 |

| 7 | 220 | 270 |

| Appearance design | ||

| Year (Anniversary) | Annual fee (AUD) | |

| electronic submission | other ways | |

| 5 | 400 | 450 |

Annual fee calculation method

The protection period for Australian invention patents is 20 years from the date of application (the protection period for drugs and medicine patents is 25 years), the protection period for utility models is 8 years from the date of application, and the protection period for designs is the longest from the date of authorization 10 years, and the registration can be renewed once after 5 years of registration.

The annual fee for an invention patent shall begin to be paid in the fourth year from the date of application, and shall be paid annually thereafter. Utility model payment starts in the second year from the date of application, and is paid annually thereafter. The annual design fee is paid in two installments, with the first payment in the first year after registration and the second payment in the fifth year after registration.